Financial discipline is back. And with it, many roles are disappearing, among them, the Agile Coaches. This isn’t because Agile itself is failing—but because capital is expensive, and companies now demand real returns on every role. It’s not just about cutting costs—it’s about making smarter financial decisions across the board, and it is a necessary correction.

For Agile Coaches, that means one thing: unless you can align and show that your interventions drive measurable business value, you’re at risk.

In this post I will go through how we got here. Specifically, how a decade of Quantitative Easing, VC incentives, experience shortage, the sudden push for remote, and tech-driven productivity increase, all lead us to the radical downsizing of Agile Coaches, and the redistributing of their responsibilities towards other roles.

But first, we need to understand how the macro economy, and specifically liquidity, affects company spending.

A decade of ZIRP (Zero Interest Rate Policies)

For over a decade, we had zero-interest rates, hypergrowth, and VCs threw money at tech companies like there was no tomorrow. Many countries’ ultra-loose monetary policy fueled global investments, and hiring sprees that led to an explosion of new roles, and the inflation of senior titles.

Free money also created an artificial competition for talent since money was not a differentiator, and companies instead looked towards innovative ways of working. Under these conditions, Agile Coaching expanded unchecked.

The abundance of money masked inefficiencies:

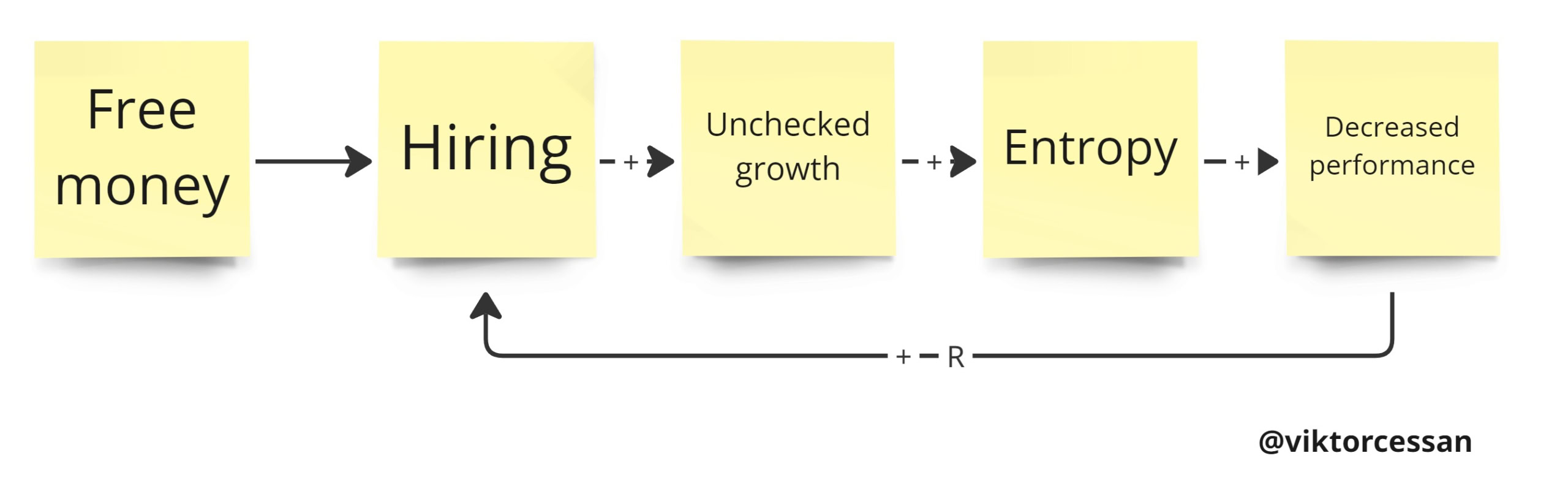

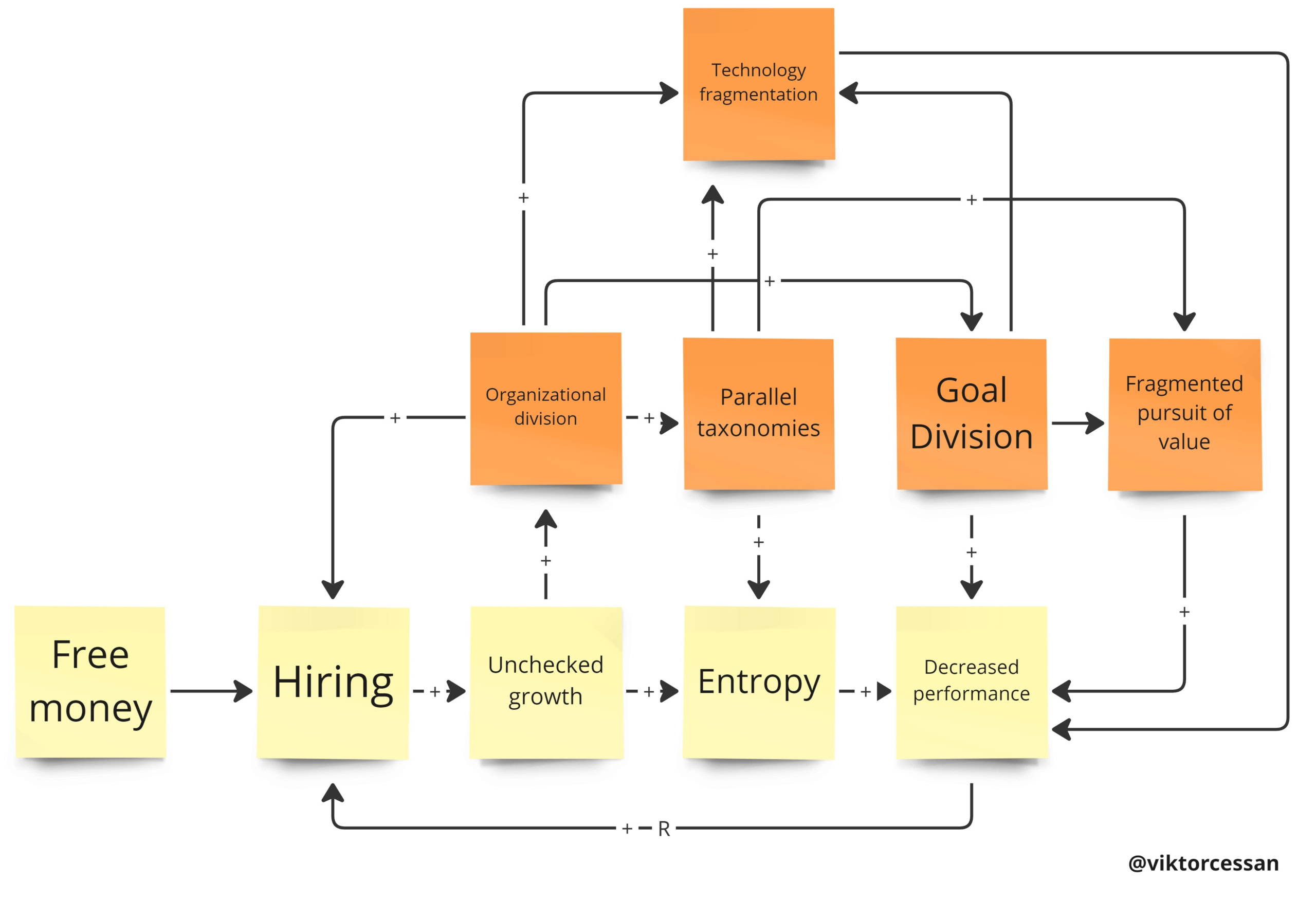

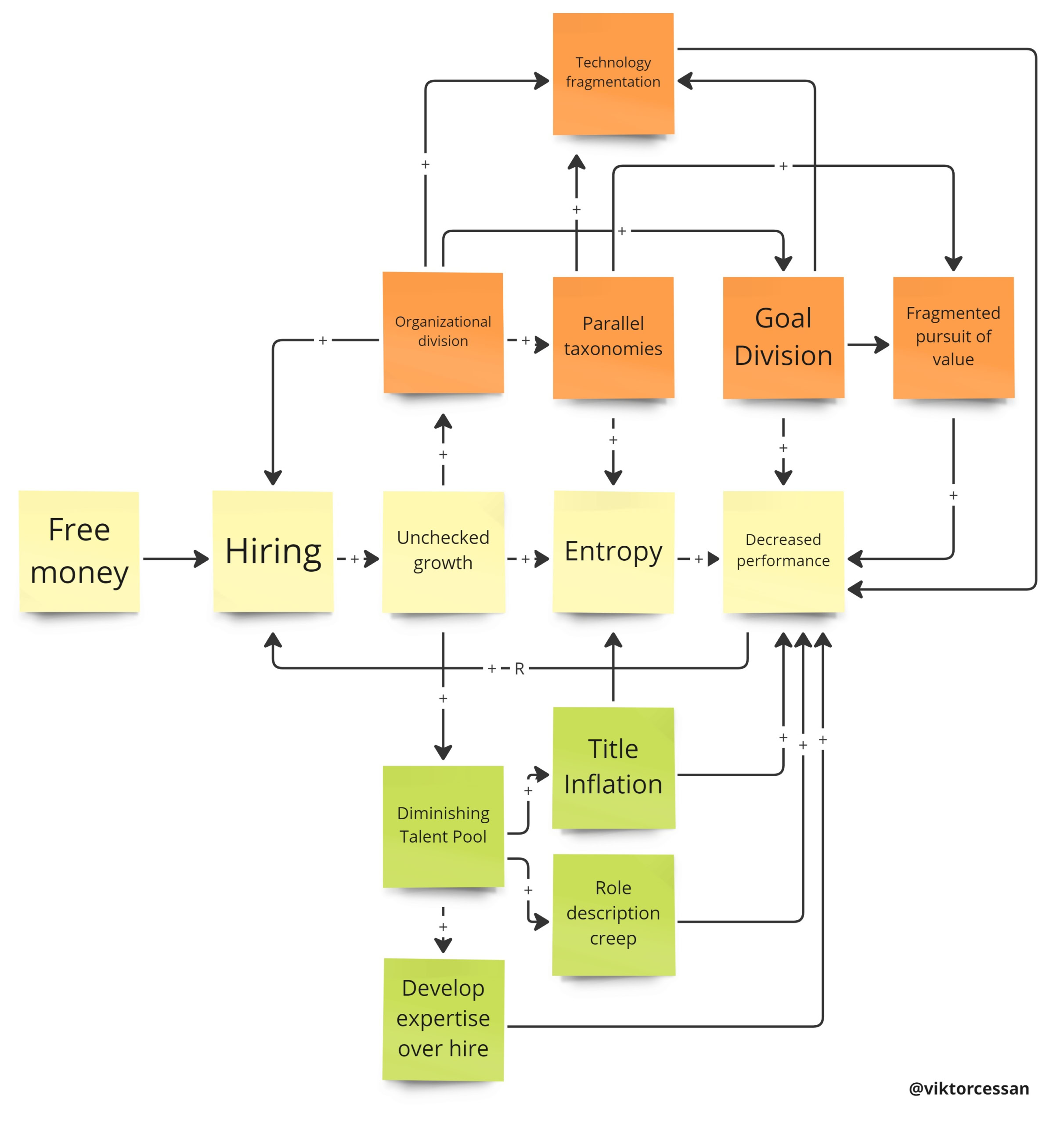

1-Companies hired too fast with increased entropy and decreased overall performance (yellow).

2-Organizational charts bloated with fragmentation of value, information, and technology as the result (orange).

3-Expertise (people with decades of experience) disappeared or got extremely hard to recruit leading to companies shifting to training expertise rather than hiring it, seniority inflated, and roles meant completely different things within and across companies, countries, and industries (green).

But as long as money was accessible for free, these problems never had to be dealt with.

At its peak, money was so abundant and transparency had collapsed so badly that employees “worked” multiple full-time jobs in parallel (the Overemployed movement).

During this decade, Agile Coaches were mostly not hired to enable and drive performance and profits—they were hired to support growth, or reduce the negative effects of growth. So when growth was suddenly no longer the priority, many coaches had a tool box and expertise not tailored for the new macroeconomic landscape that companies now existed in.

I want to point out, before I go on, that there were, and are still, many coaches that were oriented around the value stream, technology, product, and financial performance. But across my time with different clients, large and small enterprises, start ups, most Agile Coaches did not have a focus on those things.

The changing macroeconomy

In 2022, we moved from QE (Quantitative Easing) to QT (Quantitative Tightening). For those unfamiliar, QE is when liquidity is injected into the economy. To achieve this, central banks buy financial assets, and government bonds. But they also reduce the interest rates to stimulate citizens to borrow money at cheaper costs from banks which then also injects liquidity into the economy. This “pushes” liquidity into the economy.

In a QT environment, the central banks do the opposite. Instead of buying assets, they sell them, or they raise the interest rates and in doing so they “pull” liquidity away from the economy.

When inflation started soaring, central banks shifted into a QT environment which:

- Made borrowing expensive.

- Slashed consumer spending.

- Shrunk corporate cash flow.

Consumers saw purchasing power decrease while having less money at the same time. Companies could no longer burn cash freely, and every dollar spent needed justification. Before this, many companies optimized for growth, not profit, which anyone paying attention to the stock market could see in bloated P/E numbers, and direct return.

Japan’s interest rates influenced the global tech scene

If the relationship between QT and layoffs is not clear yet, consider another example. In 2024, Japan raised their interest rates to 0.5% for the first time in 17 years. Up until then, Japanese investors either borrowed money very cheaply, or at no interest, and made investments globally in broad sectors.

This skewed decision making in several ways. First, when money is free for a very long time, people start thinking it will always be free so their risk appetite increases. But second, since you could borrow at close to 0% and invest in the SP500 and get a 8%-10% return, that was seen as conservative, and people looked for ways to make money grow faster than that, particularly through unicorns. However, unicorns don’t happen overnight, and they are unprofitable for several years. But even though they’re unprofitable, the ones that succeeded always had a level of financial discipline from the start. But many tech-companies stopped being financially disciplined the cheaper money got. Very similar to how the housing market crashed because of over leveraged, you could say that the tech scene was over leveraged.

As the global economy cooled down through central bank interventions, the stock market cooled down, GDP went down, the Japanese investors saw lower return on their investments. When interests rates then suddenly increased, suddenly their loans became a liability. Naturally, they pulled back from global tech markets and the entire tech industry took a hit. Stock value went down, and VCs either saw their liquidity dry up, or didn’t dare to invest at this time.

Up until then, money was thrown at companies, and multimillion dollar VC funded companies failed every year. Now, everyone started doing their due diligence. Tightening monetary policies hit the growth companies the hardest. Several clients, and companies in the market saw their investment rounds fail, VCs pulling back offers, and companies had to stop hiring.

Many companies shifted their roadmaps, and their roles too. Product Managers, almost overnight, needed to pivot from growth at the expense of profit, to profit at the expense of growth.

QE distorted the Agile Coach role, QT did it again.

Before QT (when liquidity was pulled from the economy), the Agile Coach role had already seen a large shift. Until 2010, Agile Coaches (then not always called by that title) were former Engineers, Product Managers, founders, or executives—people who had spent years contributing and navigating complex product and tech landscapes.

But as QE increased, the demand for Agile Coaches exploded, and there weren’t enough experience people to fill the roles. With demand for Agile Coaches outpacing available experience, companies broadened hiring criteria, turning the role from an expert, and advisor, to a generalized facilitator and training role.

As hiring surged, the Agile Coach role continued changing and expanded beyond business agility into broader cultural initiatives—psychological safety, well-being, and team collaboration and harmony. Those are all crucial aspects of any healthy organization, well functioning team, and business performance.

Historically those were the responsibilities of management, leadership, and HR. And they would leverage collaboration/culture consultants whenever they needed help. But now these responsibilities got offloaded to the Agile Coach role. Not uncommon, there were Agile Coaches, who’s entire day to day over multiple years was to hold feedback workshops, facilitate online meeting etiquette discussions, and facilitate norm discussions. Again, these are all important, but if the role a company leverages to enhance value creation, coherence between the business, architecture, processes, and organization is specialized in the former, who’s keeping the eye on the prize?

Many companies thought the shift made a lot of sense. Engineering Managers were completely overwhelmed with growth. They were in daily interviews, participated in technical decisions, organizational scaling, and ensured they followed the HR-year. Meanwhile, as the market changed so fast, and entropy escalated within companies., having Agile Coaches present enabled management to offload some of the management responsibilities to Agile Coaches which alleviated growth pains, conflicts, and entropy.

But the shift away from business agility meant that when financial discipline returned, scaling stopped, and management started recovering their responsibilities, executives struggled to justify the ROI of coaching roles that weren’t directly improving delivery speed, cost efficiency, or business outcomes.

Financial focus – or bust

For Agile Coaches, we’re going to see a bi-furcation. Few companies are keeping the Agile Coach role and continuing its orientation towards reducing entropy. The Agile Coaches there will continue to focus on helping teams collaborate, reduce information degradation, manage dependencies through meetings, help make sure team members know each other, feel comfortable to speak up, and co-create, etc. Reasons for this include management profiles optimized for technical expertise, extremely large landscapes, low visibility into costs, a culture of being value driven, a technical landscape that requires large projects, labor laws preventing large changes across multiple countries.

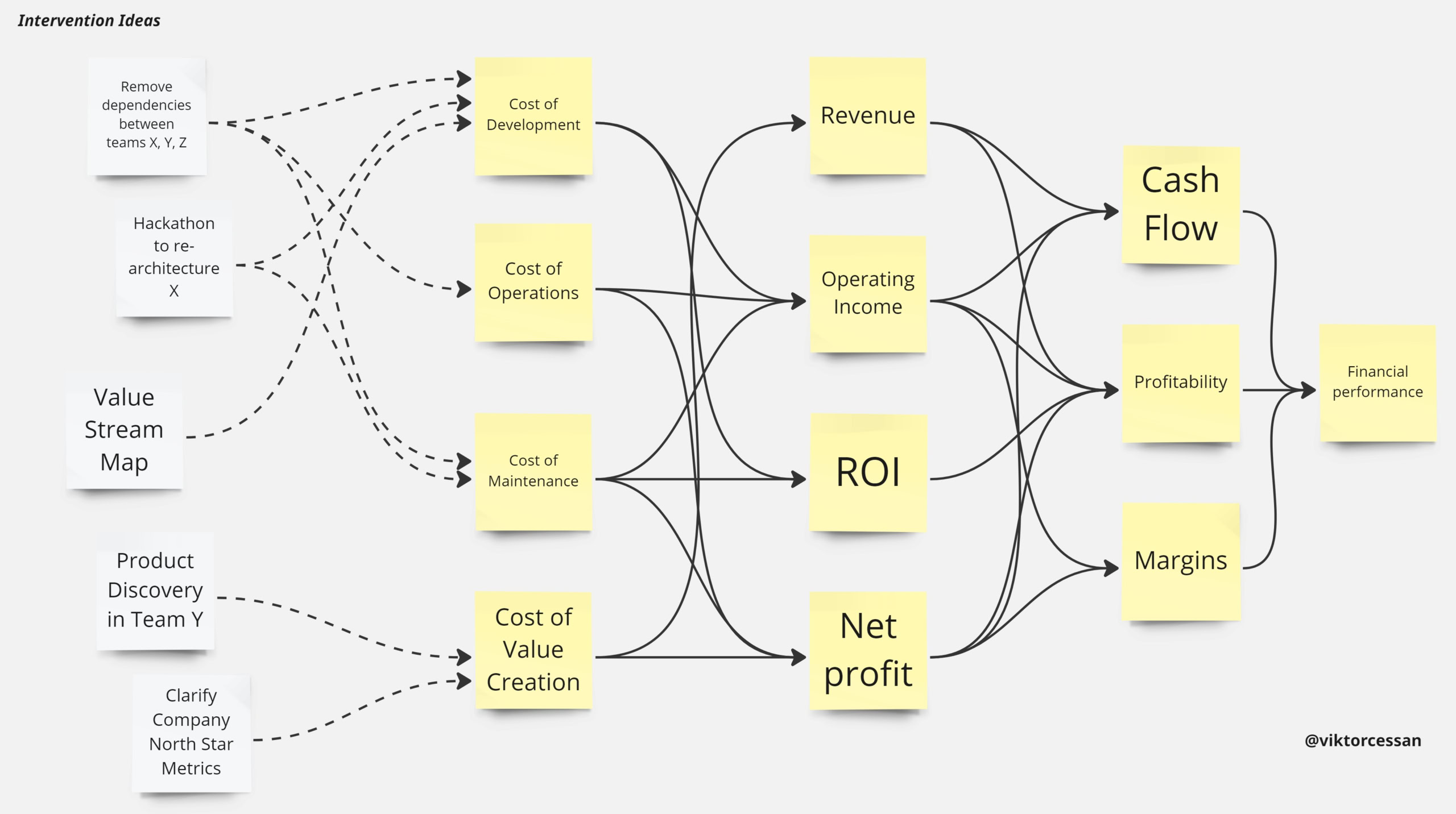

More companies, however, are going to shift Agile Coaches into directly value creating roles such as Product Owners, Product Specialists, Engineering Managers, or in some cases development. Some, very few, Agile Coaches will get to remain and be expected to contribute more clearly to Financial Performance.

They’ll target some part of a company’s metrics map (such as the one below) clearly contributing to the bottom line. For different companies, this map will look different.

But many Agile Coaches have already been let go, with more to come.

Leader-driven excellence won’t be instant

While I think this correction is necessary, and a lot of companies eventually will find their way, this down-sizing comes with a few risks.

This shift to leader-driven operational excellence won’t be seamless. Not because Agile Coaches were secretly holding everything together, rather in part because many managers were hired and optimized for a different game—growth, not technical excellence, not operational efficiency, not team performance.

For years, leadership could offload team performance to Agile Coaches and focus on scaling, and they themselves don’t have the muscle for it yet.

Cutting coaches doesn’t instantly make managers better at flow, constraints, or financial agility. And that gap? It’s going to slow things down.

What this means for the future of Agile & Coaching

Agile Coaching didn’t collapse because Agile failed—it collapsed because financial reality changed. When money was free, companies could afford inefficiency. Now they can’t.

Agile itself isn’t disappearing—it’s being embedded into leadership roles. Product Owners, Engineering Managers, and teams will be expected to utilize appropriate ways of working. Continuous improvement will shift back to those with accountability. But also, thanks to Wardley Mapping, we have a better language for understanding when Agile, or Lean makes sense, if not six sigma. But also when we ought to build it ourself, and when we ought to buy. So Agile is very much alive. But Agile Coaching is on a down turn.

At the same time, Agile Coaching as a profession isn’t completely dead—it is evolving, or it’s a renaissance is perhaps a better term.

As business agility, development, and operations become more leader and team-driven, Agile Coaching will shift to a model closer to how we use lawyers and financial advisors.

- No more open-ended engagements. The days of embedding coaches into teams indefinitely are over.

- Instead, expect short, high-impact interventions. Organizations will bring in coaches for specific needs, not long-term shadowing.

- The role will be more oriented to business, team, technology, or financial performance, and more transactional. It will focus on advising leaders, analyzing org design, and providing clarity—not necessarily doing the work for them.

This shift means Agile Coaching will become rarer, have higher expectations placed upon them, and become more results-driven. The coaches who remain will be expected to operate at a higher level, working directly with leadership focusing less on teams, and team rituals.

What Agile Coaches can do next

The macroeconomic landscape is shifting. The nature of work is evolving. Business priorities are changing. Many Agile Coaches are well positioned for leadership roles.

Instead of advising others, this is an opportunity to use that expertise directly by shifting into a Product, Engineering, delivery, or Management role.

However, for those who want to stay in Agile Coaching, the role is changing.

- Learn finance. If you can’t explain how agility affects revenue, cost, or cash flow, you’re at risk—and so is your company’s investment in you.

- Shift from ‘Agile Frameworks’ to ‘Business Outcomes.’ Whether a company uses SAFe, Scrum, or something else is less important than value, speed, cost, and efficiency. If you can’t quantify your impact, you won’t be seen as essential.

- Coaching will be more specialized and transactional. It will be about advising leadership, analyzing systems, and guiding org design—not running ceremonies or facilitating teams indefinitely.

For many, this isn’t just a career pivot—it’s a necessary correction. The question is whether to make the shift now or wait until the market forces it.

One Comment

Jay Hrcsko

Brilliant writeup Viktor! I’ve been saying much of the same for a while now….roles like coach, RTE, and Scrum Master are the result of a ZIRP driven economy, and those chickens have come home to roost. Cheers!